Artificial intelligence has become one of the most powerful forces shaping markets in 2025, but its impact is not uniform across the investment universe. Rather than asking whether AI is a “bubble,” investors may be better served by considering where in the value chain to participate, how much risk to assume, and how to balance innovation with resilience over time.

Opportunity exists beyond Nvidia and GPUs, of course, but let’s start with comparing the current conditions to what’s quickly becoming a popular point of comparison—the dot-com bubble.

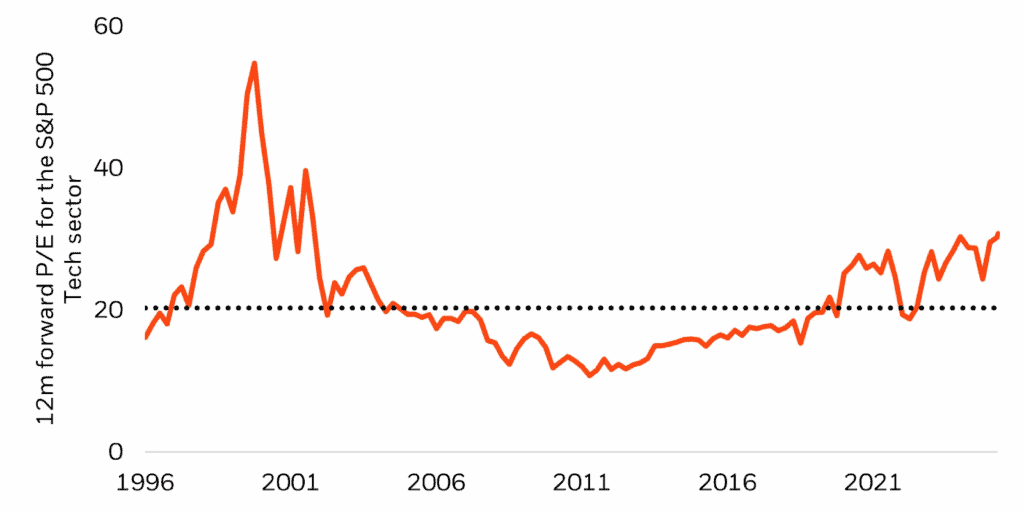

Valuations differ from Dot-Com Bubble

The current environment is drawing frequent comparisons to the late‑1990s dot‑com era, particularly given the strong gains and narrow leadership in mega‑cap technology and AI‑related companies. There are, however, important differences. Today’s market leaders tend to be large, profitable businesses with diversified revenue streams, robust free‑cash‑flow generation, and balance sheets capable of funding significant investment programs. Valuations in AI‑exposed areas of the market are elevated, but key technology indexes are trading at lower earnings multiples than those seen at the height of the dot‑com period, and they are supported by a much thicker base of current earnings.

Putting tech valuations into perspective

12-month forward Price-to-Earnings – S&P 500 Information Technology Index

Source: Bloomberg as of 10/9/25. P/E ratio as measured by the 12-month forward P/E ratio. ‘Price/Equity’ ratio is the price of the stock divided by the company’s earnings per share, aggregated to the index level.

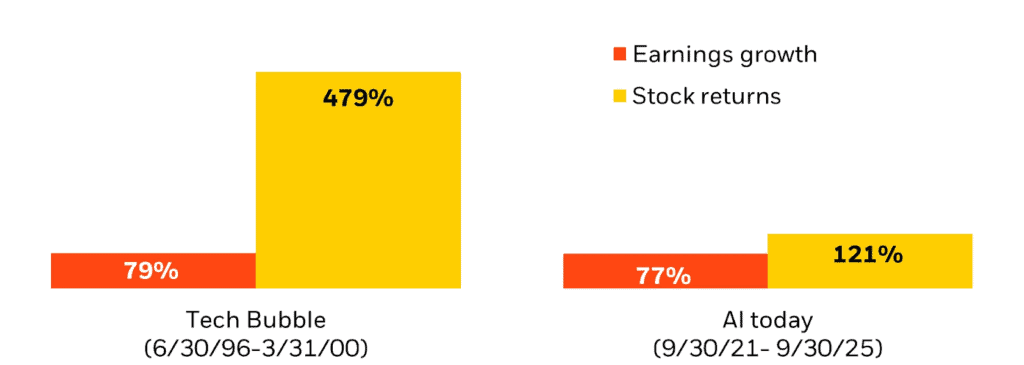

Tech bubble returns far outpaced earnings—not the case today

Earnings growth and performance (%)

Source: Refinitiv from 6/30/1996 to 3/31/2000, and AI today 9/30/2021 to 9/30/2025 (right). Price represented by the S&P 500 Information Technology Index, and Earnings represented by the I/B/E/S S&P 500 Information Technology Index consensus 12-month forward earnings. Past performance does not guarantee or indicate future results. Index performance is for illustrative purposes only. You cannot invest directly in the index.

Past performance is not indicative of future results. Index performance is for illustrative purposes only and does not reflect the deduction of fees, expenses, or transaction costs.

We can take Microsoft as an example. Although the business has benefitted greatly from the AI boom, the company exists beyond its recent arrangement with Sam Altman’s OpenAI. Share prices in the company behind Windows OS hovered around $240.22 in January 2023—this was also approximately when they announced a deeper strategic partnership with the AI-forward company. Since then, stocks have appreciated more than twofold at the time of writing.

This is where we might find a disconnect. Microsoft’s recent filings, given the company’s 27% ownership stake, imply a quarterly net loss of roughly $11.5B for OpenAI. Yet Microsoft also beat expectations as a whole, with revenues climbing 18% and surpassing $77.7B. This illustrates our point—OpenAI is a relatively new business venture embedded in a long, well-established organization.

Have share prices in Microsoft doubled exclusively due to this partnership? The likely answer is no. This suggests that other profit drivers, such as Azure cloud computing or software sales, can succeed independently. That type of resilience is native to Microsoft’s diversified revenue streams.

Any companies or securities mentioned are provided solely for illustrative purposes and do not represent a recommendation to buy or sell any security. References to stock performance are historical and not indicative of future results.

AI spending: capital cycle of data centers

One feature that distinguishes this AI cycle is how the buildout has been financed thus far. In many cases, spending on semiconductors, data centers, and networking equipment is being funded from retained earnings and existing cash reserves, rather than relying primarily on new debt issuance. That self‑funding can provide relief from climbing interest rates or tighter liquidity constraints, although it may weigh on reported free cash flow in the near term for some of the largest investors in AI infrastructure.

Yet financing strategies have evolved almost as quickly as the tech companies behind them. According to Reuters and publicly available data, there’s been a noticeable uptick in bond issuances from hyperscalers:

- Alphabet: $25B

- Meta: $30B

- Oracle: $18B

- Amazon: $15B

As major AI platforms and cloud computing service providers ramp up spending to fund the AI buildout, there seems to be a noticeable pivot toward debt financing to accrue massive amounts of money. Morgan Stanley’s calculations expect a run rate of $3T in required investments through 2028, half of which will come from cash generation, a quarter from private credit, and 10% from other sources such as sovereign wealth funds, private equity, and venture capital. That leaves a shortfall of approximately 15% ($450B) to come from bond markets. J.P. analysts predict that the glut of issuances could represent 20% of the investment-grade bond market by 2030.

From a portfolio perspective, this suggests that a number of AI‑exposed companies are choosing to reinvest from positions of strength, but will likely seek out funding in other forms as well. How well the bond market can absorb trillions remains to be seen. The eventual payoff of those investments depends on future adoption and monetization—they will need to prove themselves in practice, not in theory. Forward-looking statements are based on current assumptions, expectations, and available information and are subject to risks and uncertainties. Actual results may differ materially.

Infrastructure: an essential foundation

The most visible expression of AI today is not only in applications like Sam Altman’s ChatGPT, but in the infrastructure that makes them possible. Research indicates that global power demand from data centers could rise materially over the rest of the decade, with estimates of an increase of as much as 165% by 2030 as workloads become more compute‑intensive. At the macro level, investment in data centers and related information‑processing equipment has become a significant contributor to U.S. economic growth in 2025—recent analysis suggests these categories accounted for roughly 92% of GDP growth in the first half of the year, even though they represented a much smaller share of total output.

This has two implications. First, demand for reliable power, transmission capacity, and critical infrastructure is deeply rooted in a functioning, digitized economy and is not solely dependent on any single AI application’s commercial success. Second, private and public infrastructure assets involved in power generation, grid upgrades, and specialized data centers may participate in AI‑driven growth while also serving broader needs such as cloud computing, payments, and communication services. In that sense, infrastructure can offer exposure to AI‑linked trends while also remaining connected to everyday economic activity, although it is still subject to its own risks, including regulatory changes, cost overruns, and demand uncertainty.

Where AI value may be captured

On the AI “front end,” the picture is more nuanced. Surveys suggest that while interest in AI remains high, many companies are still in early stages of adoption with varying levels of success, and a meaningful proportion report limited or no incremental revenue from AI initiatives to date. Over time, value may be more likely to accrue to firms that integrate AI into concrete workflows—improving efficiency, reducing operating expenses, or enabling new products—rather than those that simply brand themselves as AI‑enabled. This could include software and services that plug into existing business systems and help re‑engineer processes in areas such as finance, operations, customer service, and logistics.

For diversified equity investors, this perspective supports looking beyond a narrow set of hyperscalers and hardware suppliers to companies across sectors that can demonstrate measurable productivity gains from AI. At the same time, there is no guarantee that all AI‑related investments will generate acceptable returns, and some business models may prove less durable than early share‑price performance suggests.

When capex does the heavy lifting

Another consideration is how much AI‑related capital spending is presently contributing to economic data. Recent work from academic and market researchers indicates that investment in data centers and information‑processing technology has been responsible for a disproportionate share of U.S. GDP growth in early 2025; without it, growth would have been near stagnant. This concentration underscores both the importance and vulnerability of the theme. Portfolios that ignore AI and digital infrastructure entirely may be implicitly underweight a key driver of current activity, while portfolios that are heavily concentrated in a small group of AI leaders could be more exposed if capital expenditures slow or fail to deliver the expected productivity gains.

In this context, infrastructure again plays a supporting role. Estimates suggest that meeting projected data‑center power demand will require substantial utility and grid investment, potentially running into the hundreds of billions of dollars globally over the coming years. These projects are long-dated, capital-intensive, and often depend on regulatory support, but they also reflect needs that extend beyond any single technology cycle, such as electrification, cloud migration, and digital payments.

Trend versus fundamental demand

A natural question is whether recent developments are merely a trend or reflect a durable shift in demand. On the infrastructure side, the case for durability appears relatively strong: growing data volumes, continued cloud adoption, and more software‑mediated business processes all point toward sustained demand for compute and storage capacity. On the adoption side, however, the path may be uneven. Multiple surveys show that many organizations are proceeding cautiously, advancing from pilots only when AI solutions demonstrate a clear return on investment or cost savings. This combination—robust infrastructure spending and measured ROI‑driven adoption—suggests that while AI’s long‑term potential is significant, the timeline from investment to realized earnings may extend over several years rather than quarters.

Implications for diversified, long‑term investors

For investors, AI is unlikely to be a simple “in or out” decision. Instead, the question becomes how to express exposure along the AI value chain—raw materials, platform companies, semiconductors, workflow software, and enabling infrastructure—within the context of individual objectives, risk tolerance, and liquidity needs. A diversified approach might include measured allocations to established technology leaders, targeted exposure to companies building practical AI use cases, and thoughtful participation in infrastructure and power assets that support both AI and the broader economy, recognizing that each component carries distinct risks.

As with any period characterized by innovation and elevated expectations, there is potential for both exceptional outcomes and disappointments. Long‑term financial goals do not typically change as quickly as markets do, but the path toward those goals may require periodic adjustment. In our view, disciplined investors may benefit from focusing on fundamentals—profitability, cash‑flow generation, balance‑sheet strength, and reasonable valuations—while maintaining diversification across sectors, regions, and asset classes rather than making concentrated bets on any single theme.

Given the current backdrop, conversations with your trusted advisor around concentration risk, scenario planning, and how AI‑related investments fit within a broader multi‑generational plan can be particularly valuable.

Promus Advisors, an SEC-registered investment adviser, is an affiliate of Bellwether Investment Management, Inc. (“Bellwether”). Promus Advisors provides fee-based asset management and advisory services. Bellwether and Promus Advisors have entered into arrangements in which Bellwether may refer clients with financial advisory needs to Promus Advisors. Please note that SEC registration does not constitute an endorsement of the firm by the Securities and Exchange Commission, nor does it indicate that the adviser has attained a particular level of skill. Promus Advisors and its investment adviser representatives are in compliance with the current filing requirements imposed upon SEC-registered investment advisers by those states in which Promus Advisors maintains clients.

Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy will be profitable, equal any corresponding performance level(s), or be suitable for any specific client’s portfolio. Promus Advisors does not guarantee that any benchmark or indices used by Bellwether will match a given portfolio. Furthermore, asset allocation and/or diversification does not necessarily improve an investor’s performance or eliminate the risk of investment loss.