KEY MESSAGES FROM YOUR INVESTMENT TEAM

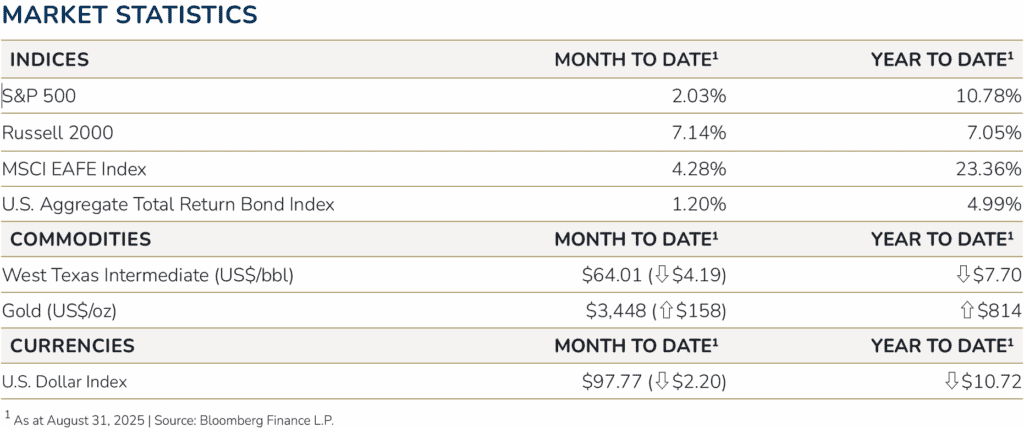

Upward equity trends extended into August, and this time around, fixed income markets went along for the ride. Both outcomes are certainly appreciated, but they come with caveats as well.

Stock prices, for example, were propped up by generally positive earnings reports. The good news managed tocrowd out worries surrounding inflationary pressures and developments in the labor market—both of which traditionally signal weaker economic growth. On the other hand, rising unemployment gives the U.S. Federal Reserve (“Fed”) reason to reduce interest rates in their September meeting. Investors have priced this in accordingly.

The White House—along with investors, developers, and many businesses—is keen for softer monetary policy to reduce interest burdens on federal debt loads. Unfortunately, intermittent remarks about removing Chairman Powell from his post seem to have cast doubt on the Fed’s independence, pushing long-term yields higher. Bond investors are more conservative by nature and enjoy reassurance, checks and balances, and order. Questions surrounding the central bank’s self-governance have diminished confidence in its ability to keep inflation at target levels. If political influence can bend policy decisions, bond markets stand to lose one of their key indicators for forward-looking returns.

Both major asset classes are rewarding investors regardless of lurking concerns, of which many stem from this year’s buzzword—tariffs. Duties on imported goods have created hurdles, but they now face their own on the court circuit after being ruled illegal. Yet there is still plenty of ground to cover before we consider the decision conclusive. Even if the Supreme Court upholds the previous decision, the GOP could get creative with alternative methods to levy import taxes. Tax breaks need revenue offsets—tariffs, for better or worse, are the perceived immediate solution.

Many of the global market’s influential forces are in flux. In times like these, strategic positioning is crucial to take advantage of new circumstances. An emerging theme to monitor is the shift from demand-side government outlays toward supply-side corporate spending. By design, the One Big Beautiful Bill Act (“OBBBA”) should mechanically thin the public sector and encourage capital to funnel into the private sector. The transition will cause ripples, but the aim is to create a more productive growth model. Periods of profound change often invite disruption and opportunity in equal measure.

Outlook

FIXED INCOME

Investors have largely subscribed to inbound interest rate reductions in September. In response, August closed out with rising bond markets. We hold similar beliefs to the consensus—the Fed should have ample opportunity to provide some level of relief as labor markets continue to stumble. Inflation creeping up might eventually complicate the situation, however.

Similar views, but not identical. The consensus forecasts approximately five rate cuts by the end of 2026, which is likely an overestimation if inflation persists or growth accelerates into the new year. As such, government treasuries aren’t likely to sustain their performance as well as municipal bonds—particularly longer duration ones—on an after-tax basis. For context, the 5-year/30-year AAA municipal bond spread is currently more than double the U.S. Treasury curve.

GLOBAL EQUITIES

Q2 earnings results were surprisingly strong, with an annual running growth rate of nearly 12% in the United States. Most companies beat expectations, suggesting sound leadership in reconciling trade policy troubles through price hikes and cost-saving measures. That said, businesses front-loaded purchases ahead of tariffs—difficulties might arise as those reserves run dry. Some have noted that leading technology companies—which have shaped global markets for several years now—have recently experienced modest selling pressure. Realistically, the scenario is likely a case of investors taking profits off the table during the market’s richest valuation in history.

Along a similar vein, the growth behind AI has been almost exclusively tied to training large language models (LLMs), which constrained revenue to a handful of hyperscalers building infrastructure. More recently, AI is pivoting toward inference-based reasoning. This new logic structure will allow AI software to draw conclusions on novel datasets rather than relying on previous examples and reiterations. These developments can be considered a transition from learning to actually doing, which is where the technology’s promised efficiencies will likely be found.

ALTERNATIVE INVESTMENTS

As noted, the transition from infrastructure development—energy generation, data centers, and cloud computing—is beginning to slow after a blistering pace of capital expenditures from some of the world’s largest companies. This might be an inflection point of sorts as businesses shift their attention toward monetizing these hefty investments.

Ultimately, the momentum behind AI and the wider market has been driven by buildouts at unprecedented speed and peak investor enthusiasm. But it has also been restricted by lower corporate adoption and implementation into existing workflows.

High-bandwidth memory solutions, efficiency, power availability, and scalability, which translate capital inflows into real-world utilization and proportional revenue, will inform future success. That will take time, and until then, depreciation may weigh on long-term assets as well as profitability growth. Selectivity will be a useful practice.

Promus Advisors, a SEC registered investment adviser, is an affiliate of Bell Bellwether Investment Management, Inc. (“Bellwether”). Promus Advisors provides feebased asset management and advisory services. Bellwether and Promus Advisors have entered into arrangements in which Bellwether may refer clients with financial advisory needs to Promus Advisors. Please note that SEC registration does not constitute an endorsement of the firm by the Securities and Exchange Commission, nor does it indicate that the adviser has attained a particular level of skill. Promus Advisors and its investment

adviser representatives are in compliance with the current filing requirements imposed upon SEC registered investment advisers by those states in which Promus Advisors maintains clients.

Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy will be profitable, equal any corresponding performance level(s), or be suitable for any specific client’s portfolio. Promus Advisors does not guarantee that any benchmark or indices used by Bellwether will match a given portfolio. Furthermore, asset allocation and/or diversification does not necessarily improve an investor’s performance or eliminate the risk of investment loss.