“Municipal networks expand economic opportunities. We’ve got to open new doors, not slam them shut.” — Frank Lautenburg

With heightened yields, attractive valuations, robust fundamentals, and supportive technical factors behind them, current market dynamics are making a compelling case for municipal bonds, otherwise known as munis.

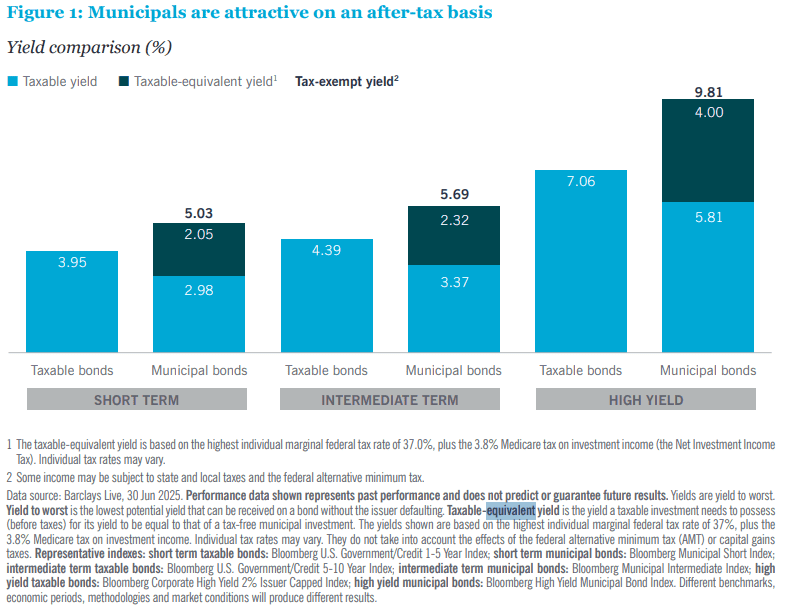

While tax-exempt income is always appreciated, conditions like these compound the appeal of municipal bonds—especially for high-income, long-term investors that concern themselves with tax bracket management.

Tailwinds at a glance

- Market dynamics: Substantially high issuances have skewed the supply side of the equation, causing munis to underperform other fixed income assets, raising yields, and introducing relative value opportunities.

- Attractive entry: Municipal-to-Treasury yield ratios are quite convincing as new investment opportunities, sitting at their best levels since October 2023’s broad selloff event related to interest rates.

- Seasonal forces: Supply typically contracts in the summer, which plays off of increased reinvestment demand from July and August maturities quite well—this could provide momentum throughout the rest of 2025.

- Legislative clarity: With munis retaining their tax-exempt status in the One Big Beautiful Bill Act, plenty of the uncertainty previously weighing on them has now been diminished. Sector-specific risks remain.

- Monetary policy: Although the number of interest rate cuts has been revised lower for several reasons, we’d expect demand to pick up once monetary policy is less restrictive and investors rotate from cash to munis with higher than average yields.

Quick context: explaining the yield curve

For context, the yield curve indicates economic forecasts, and when it becomes steeper as long rates rise relative to short ones, market expectations foresee economic growth and higher inflation in the future. Given how inflation erodes the value of a dollar—and that it’s a slow, virtually consistent effect—investors begin to demand higher interest payments on longer-term loans to preserve the future value of their investment.

In simpler terms, the nominal yield is the stated return on paper. The real return adjusts for inflation.

Naturally, longer-maturity bonds (up to 30 years in the U.S.) carry more term risk, as inflation and rates have more time to fluctuate and erode real returns. Higher yields compensate for that risk—without them, investors might stick to rolling over short-term bonds.

With this in mind, let’s analyze why current conditions are supportive of municipal bonds and some of our views on how your portfolio can capture the momentum.

Call structures reduce duration risk

With municipal-to-Treasury ratios increasing on longer maturities, there’s value to be found. Notably, investors can find an extra 197 bps by shifting from short to long duration.

More than half of this additional yield is range-bound to 10- and 20-year munis, which is important for our sake. It’s quite common for issuers in Dallas, Texas, to exercise call features after 10 years but ahead of the full maturity date for longer-term bonds. This allows the issuer to refinance at more desirable interest rates, which also benefits the investor by mitigating overall duration risk without sacrificing greater yields. Bonds are issued under the assumption that they’ll reach their full term, which is reflected in their interest payments. In practice, munis are commonly called ahead of time.

| Call Features: An early “exit clause” from the loan agreement allowing the issuer to “call” (redeem or pay off) the bond before its full maturity date. |

For rate-sensitive investors

Short-duration high-yield municipal bonds yielded 4.74% to end last quarter. In tax-equivalent yield (“TEY”) terms, that’s 8.01%, meaning the after-tax return to taxable bonds. This provides solid income for investors wary of interest rate swings. With credit spreads at +186 bps—66 wider than those on long-duration high-yield munis—the current “inverted” credit spread curve (where short-term spreads are unusually high) creates a unique chance to diversify short-duration portfolios. This opportunity comes at a time when the Fed weighs keeping rates steady against possible cuts.

| Tender Option Bonds: A leveraged structure that splits a long-term bond into short-term floating-rate notes (often sold to funds) and a residual “inverse floater” for investors. It amplifies yields by borrowing at low short-term rates, but adds risk if rates rise. |

For those chasing higher total returns, stretching into longer durations via high-yield strategies with tender option bonds (“TOBs”) is viable. Duration exposure has dragged performance previously, but a steeper yield curve—plus expected Fed rate cuts in late 2025—could strengthen longer-duration strategies. Lower borrowing costs from those cuts would likely boost TOB-supplemented strategies, which would lend themselves well to delivering better overall returns and income through smart leverage as market conditions evolve.

Sectors for further consideration

Municipal bonds are issued by local institutions in need of funding, such as the Dallas Community College or Dallas Fort Worth International Airport, and certain sectors face their own challenges. The One Big Beautiful Bill Act has preserved tax-exempt income for munis, but future policy and regulatory changes could present transitory risk and opportunities.

- Healthcare: Changes to Medicaid might influence provider tax policies or introduce more stringent eligibility requirements, pressuring a vital revenue stream for non-profit hospitals.

- Infrastructure: Substantial projects aimed at improving transportation infrastructure could receive less government support, hindering progress and profits.

- Education: Certain institutions have come under fire and may be at risk of losing sizable grants, facing higher taxes on endowment funds, and reduced student loans—all of which may impact enrollment and tuition increases.

Each sector participant in the three categories above faces similar potential challenges, but they each possess a unique profile on how well they’ll overcome adversity. The financially strong will most likely outperform those with less robust balance sheets, making them more sought after relative to their peers. Identifying these opportunities will be crucial, and selectivity will likely serve investors better than broad-sector credit exposure.

Optimizing institutional portfolios

Institutional players also stand to gain from recent developments along the yield curve by taking part in new issuances. Strategically, replacing shorter-call, lower-coupon assets with new ones—particularly those with 5% distributions and 2035 call dates—can add a new layer of more appealing asset structures.

U.S. Federal Reserve projections

The Fed made no adjustments to monetary policy in June, although the tone felt slightly more promising than previous meetings. Although many foresaw several significant interest rate reductions this year, our base case remains unchanged—tariffs act as a deterrent to lowering rates.

Regardless, there’s still room for improvement. Chair Jerome Powell may be in a difficult position with upward pressure on inflation and downward pressure on economic growth, but we can anticipate smaller, more modest cuts.

Even if only one or two reductions are seen throughout the rest of 2025, it’s reasonable to assume that investors will recall cash positions and rotate into municipals to capture additional yield that’s no longer available in money market funds, certificates of deposit, short-term Treasury bills, or cash equivalents.

Municipal bonds on sale

If that rotation occurs, any form of surging inflows would likely have an outsized effect on demand due to prior headwinds. Given their underperformance compared to the wider fixed income market during Q2—the yield curve steepened dramatically, causing existing long-term assets to sink—this weak demand made sense.

The difference between now and then, however, is that being caught holding assets while the curve steepens is detrimental. Older issuances lose value as new ones with higher rates enter the market. In contrast, recent structural forces seem more conducive to buying into the rising yield curve.

Further, supply has been high thus far in the year, breaking out of 2024’s recent record-breaking levels by 16% despite April’s volatile outing. Dealers have been cautious with their footing, showing preference for the 1- to 15-year range, which has also contributed to a skewed curve.

We’ll need to pay close attention this summer, as reinvestment needs from bonds maturing or being called on early. If this is the case, we could witness a more impressive performance in the second half of the year. Here’s what we’ve seen so far during the last week of July, per LSEG Lipper data:

| Category | Net Flows ($ millions) |

| Intermediate | +573 |

| Short & short/intermediate | +212 |

| Long-term | +202 |

| High-yield | +44 |

| Mutual funds net inflows | +937 |

| YTD net inflows | +16,000 |

| Notable Deals | Deal Size ($ millions) |

| Brightline Trains (FL) | $1,800 |

| New York City General Obligation (NYC) | $985 |

| Metric | Value | Change |

| Last week’s new issuance | $14.0B | +6% WoW |

| Annual new-issue supply | $341.0B | +25% YoY |

| Tax-exempt issuance | – | +26% YoY |

| Taxable issuance | – | +6% YoY |

During that final week, the spread between 5-year and 30-year AAA-rated municipal bonds stood tall at 214 bps—more than double the equivalent U.S. Treasury curve. This extreme steepness is uncommon, appearing just three times since 2006. As noted in Morgan Stanley’s recent report, when this spread exceeds 200 bps, the long end of the muni yield curve has historically delivered strong 12-month forward returns, averaging 11.60%. This level of performance marks an attractive spot for investors seeking tax-advantaged yields in an environment that seems to predict a measure of inflation, growth, or a combination of both. (Source: Bloomberg, MSIM. As of July 31, 2025)

Investing in necessity

Like infrastructure, municipal bond issuers are monopolistic in nature and demonstrate strong cost pass-through alongside margin protection. The services they fund are often essential, not discretionary, which can benefit portfolio construction through their inherent defensive qualities.

In most settings, their conservative traits and tax-advantaged benefits are compelling enough on their own to be included in a diversified fixed income sleeve. The circumstances at hand, however, add new, attractive, and potentially quite lucrative layers to a sound investment strategy.

This material is provided for informational purposes only and does not constitute personalized investment, tax, or legal advice. Advisory services are offered through Promus Advisors, an SEC-registered investment adviser. Registration does not imply a certain level of skill or training. Any companies, issuers, or securities mentioned are provided for illustrative purposes only and do not constitute a recommendation to buy or sell any security. All investments carry risk, including the potential loss of principal. Past performance is not indicative of future results. Forward-looking statements are subject to risks and uncertainties, and actual outcomes may differ materially. Tax-equivalent yields and other tax considerations will vary based on an investor’s individual circumstances.