“And there’s another important point in favor of tax diversification: control over your taxable income.” – Morningstar

Saving for retirement is straightforward in theory: set money aside regularly, invest it wisely, and let compounding do the work. In practice, it’s more nuanced. The real challenge isn’t just how much you save—it’s where you save.

2025 Developments for Retirement Accounts

In 2025, investors face more moving parts than in the past. Contribution limits have been raised, the SECURE 2.0 Act changed the rules for Roth 401(k)s, and Washington is weighing whether 401(k) plans should be allowed to include private equity and other alternative assets. For investors in Texas, where incomes are not subject to state-level taxes, the key question is sequencing: should contributions flow first into traditional accounts, Roth accounts, or taxable investment vehicles?

Traditional Accounts: The Familiar Foundation

For decades, traditional accounts—401(k)s and IRA plans—have been the foundation of retirement savings. They’re popular for good reason. Contributions reduce taxable taxes in the year they’re made, and the investments inside grow on a tax-deferred basis.

The IRS increased 401(k) limits in 2025, allowing workers to contribute up to $23,500 through the employer-sponsored plan, with another $7,500 available in “catch-up” contributions for those over 50. For those between 60 and 63, that “super catch-up” rate increased to $11,250.

IRAs have smaller limits—$7,000, or $8,000 if you’re above 50 years old. The major benefit is that they are available to anyone with earned income, meaning they can be contributed to individually and not as an employee.

The rules, however, shape how useful these accounts are over time. Withdrawals before age 59½ may trigger penalties, and at 73, required minimum distributions (RMDs) force withdrawals and potential tax liabilities. For affluent retirees, those distributions can create significant drag, sometimes at precisely the wrong time by throwing off tax bracket management strategies.

Traditional accounts make sense for those in high current tax brackets who want to reduce taxable income today. But as a sole strategy, they can be limiting. Without complementary Roth or taxable savings, retirees may be left with little flexibility in managing distributions later.

When traditional IRAs and 401(k)s make sense

- You’re in a high tax bracket today and could benefit from immediate tax relief.

- An employer offers matching contributions, which enhances the benefit at no extra cost.

- You plan to diversify with Roth or taxable accounts to soften the impact of future RMDs or higher taxes.

Roth Accounts: The Long-Term Planning Hedge

Roth accounts have an inverted advantage compared to traditional ones. Contributions are made with after-tax dollars, but the payoff comes later—all qualified withdrawals are tax-free. That makes Roths particularly appealing for younger investors, or anyone who expects their tax rate to rise in the future. As an aside, it’s reasonable to assume that tax rates will rise in later years regardless of your bracket. Government spending requires revenue offsets, after all. Keep this point in mind.

The Roth IRA comes with limits—$7,000 a year, $8,000 with catch-up—and income restrictions. In 2025, contributions begin to phase out for single filers at $146,000–$161,000 and joint filers at $230,000–$240,000. High earners often run into these upper limits.

The Roth 401(k) addresses that problem. No income limits apply, and participants can contribute up to the same $23,500 cap as a traditional 401(k). Importantly, under SECURE 2.0, Roth 401(k)s are no longer subject to RMDs.

For affluent investors who can’t contribute directly to a Roth IRA, there are still paths forward. The backdoor Roth IRA strategy—contributing to a traditional IRA and then converting it—remains a strategy worth discussing with an advisor. While generally permitted under current IRS guidance, the strategy is subject to ongoing review and comes with complex tax reporting requirements. It’s best suited for high-net-worth investors whose main concern is optimizing the wealth they’ve already built.

In short: Roth accounts don’t lower today’s tax bill, but they can create meaningful flexibility decades from now. They also play an outsized role in estate planning, since Roth assets can pass to heirs with fewer complications.

When Roth IRAs and 401(k)s make sense

- Current tax rates are relatively low compared to projected future rates.

- Long-term diversification of tax events is planned for ahead of time.

- Estate planning is a consideration, since Roths can be passed on tax-free.

Taxable Accounts: Liquidity Beyond Contribution Limits

Once retirement account limits are filled, taxable brokerage accounts come into view. They don’t provide the same tax sheltering, but they bring freedom. Contributions aren’t capped, funds are accessible at any time, and there are no required distributions.

Of course, investments here are taxed along the way—dividends and interest in the year they’re received, capital gains when realized. But the long-term capital gains tax rates (0%, 15%, or 20%, depending on income) are typically lower than ordinary income rates. For wealthy households, pairing taxable accounts with charitable giving strategies—such as donating appreciated stock—can also limit tax exposure.

These accounts become especially important for affluent Americans who regularly save beyond tax-advantaged account contribution limits. They also offer estate planning benefits: heirs generally inherit assets with a step-up in cost basis, resetting the cost basis for calculating future capital gains.

In other words, these accounts aren’t a substitute for retirement accounts. They can be considered more as a release valve—an additional layer that provides liquidity and flexibility once tax-advantaged contributions are maxed out.

| Step-up cost basis: A tax provision that adjusts the cost basis of an inherited asset to its fair market value (FMV) on the date of the previous owner’s death. For example, if John purchased his home for $250,000 and it appreciated to $1,000,000 FMV, the inheritor would use $1,000,000 to calculate capital gains at the future point of sale. |

When taxable accounts make sense

- You’ve maxed out retirement contributions and still want to invest.

- You want funds available for pre-retirement goals, such as real estate or business opportunities.

- Estate planning matters, since heirs typically receive a step-up in cost basis.

Legislative Landscape in Motion

The framework above is well-established, but the ground is shifting. A few recent developments highlight why having an advisor to capitalize on emerging circumstances can help your overall retirement strategy:

Contribution limits are rising. For 2025, the 401(k) cap increased to $23,500, a record high.

Roth 401(k)s now carry fewer restrictions. SECURE 2.0 eliminated RMDs for Roth workplace accounts, making them nearly identical to Roth IRAs in terms of distribution rules.

Private equity and alternatives in retirement plans are on the horizon. A White House directive is pushing regulators to expand eligible retirement investments, potentially including private equity, real estate, and other alternatives. That change, while still speculative, could reshape how investors use their 401(k)s—introducing new opportunities and risks.

Each shift changes the planning calculus. What looked optimal a few years ago may need updating today.

Retirement Savings Sequencing in Practice

If there’s a universal lesson, it’s that sequencing matters. Here’s how it often plays out across different stages of life:

Early-career professionals

If available, younger professionals can capitalize on 401(k) to capture additional growth through defined contribution plans and employer-matching programs. They’d also usually benefit from Roth contributions. New careers often mean tax brackets are lower, growth potential is high, and the tax-free withdrawal feature is useful decades down the road. Excess savings can be directed toward IRAs, traditional or otherwise.

Mid-career high earners

This group tends to lean on traditional 401(k)s for the immediate deduction. Still, adding Roth exposure—through a Roth 401(k) election or a backdoor Roth—can help prevent overconcentration in pre-tax assets. Taxable accounts become a natural overflow afterwards.

Near-retirees

Older cohorts face the challenge of potential RMDs. Many use partial Roth conversions in lower-income years leading up to age 73, smoothing out their future tax liability. Brokerage accounts provide liquidity for goals like travel, philanthropy, or funding large one-time expenses without incurring additional distributions and their resulting taxes.

None of these are hard rules. The right order depends on income, career trajectory, and personal goals. But across profiles, a common theme emerges: the most resilient plans draw from all three account types.

Why Tax Diversification Across Account Types Matters

Diversification is often discussed in terms of investments—stocks, bonds, real estate. But tax diversification is just as important. Having assets spread across traditional, Roth, and brokerage accounts offers retirees one of their most valuable tools—the option to choose which pool of money to draw from each year.

This flexibility can determine whether retirees remain in a lower tax bracket or shift into a higher one. It can reduce exposure to Medicare surcharges or minimize how much Social Security is taxed. Most importantly, it allows wealth to be structured not just for today’s needs but for the next generation.

The Right Tool(s) for the Job

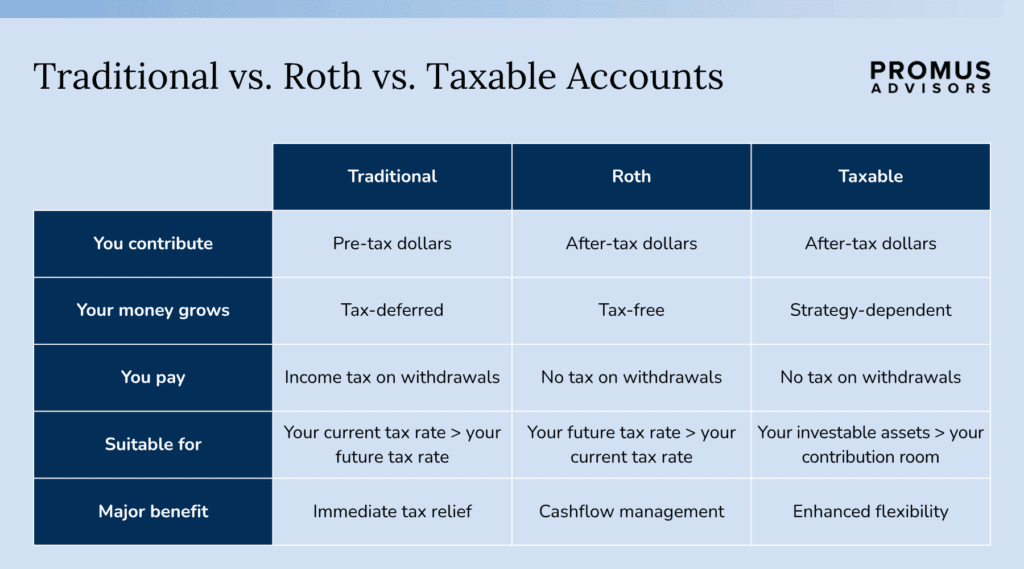

Like stocks, the debate over traditional vs. Roth vs. taxable accounts isn’t about picking a single winner. It’s about sequencing and balance. Traditional accounts provide upfront tax relief, Roth accounts deliver long-term predictability, and everyday investment accounts offer liquidity and estate advantages.

For affluent investors in Dallas, the best results often come from blending all three. With contribution caps rising, distribution rules evolving, and alternative assets potentially entering retirement plans, now is the time to reassess priorities. The rules will continue to shift—but a strategy rooted in diversification and flexibility remains a reliable path to long-term security.

And that strategy is precisely what you’ll find with Promus Advisors.

Promus Advisors, a SEC registered investment adviser, is an affiliate of Bellwether Investment Management, Inc. (“Bellwether”). Promus Advisors provides fee-based asset management and advisory services. Bellwether and Promus Advisors have entered into arrangements in which Bellwether may refer clients with financial advisory needs to Promus Advisors. Please note that SEC registration does not constitute an endorsement of the firm by the Securities and Exchange Commission, nor does it indicate that the adviser has attained a particular level of skill. Promus Advisors and its investment adviser representatives are in compliance with the current filing requirements imposed upon SEC registered investment advisers by those states in which Promus Advisors maintains clients.

Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy will be profitable, equal any corresponding performance level(s), or be suitable for any specific client’s portfolio. Promus Advisors does not guarantee that any benchmark or indices used by Bellwether will match a given portfolio. Furthermore, asset allocation and/or diversification does not necessarily improve an investor’s performance or eliminate the risk of investment loss.